10 Best Exercises for Men to Get a Lean Waistline – Reality check: Is your thick waistline making you self-conscious? As men, we all crave that lean, chiseled waistline that’s a hallmark of a strong, muscular physique. That’s why Eat This, Not That! spoke with an expert who shares 10 of the best exercises for men to get a lean waistline.

10 Best Exercises for Men to Get a Lean Waistline – Reality check: Is your thick waistline making you self-conscious? As men, we all crave that lean, chiseled waistline that’s a hallmark of a strong, muscular physique. That’s why Eat This, Not That! spoke with an expert who shares 10 of the best exercises for men to get a lean waistline.

Shrinking your waistline isn’t just about looks or fitting into your favorite pair of jeans. A trim waist also signifies good health. According to the National Institutes of Health (NIH), carrying excess fat around your midsection increases your risk of heart disease and type 2 diabetes—two of the top 10 killers worldwide, the World Health Organization (WHO) reports.

Fortunately, the path to a lean waistline doesn’t have to be daunting, filled with endless sit-ups or extreme diets. That’s why we consulted TJ Mentus, CPT, a certified personal trainer at Garage Gym Reviews, who serves up the 10 best exercises for men to shed belly fat and sculpt a toned midsection. No gimmicks, no shortcuts—just tried-and-true movements that target those stubborn love handles and reveal your hidden abdominal muscles. And the best part? They require minimal equipment and most can be done in the comfort of your home or at a nearby park.

Read on for a detailed breakdown of 10 of the best exercises for men to get a lean waistline.

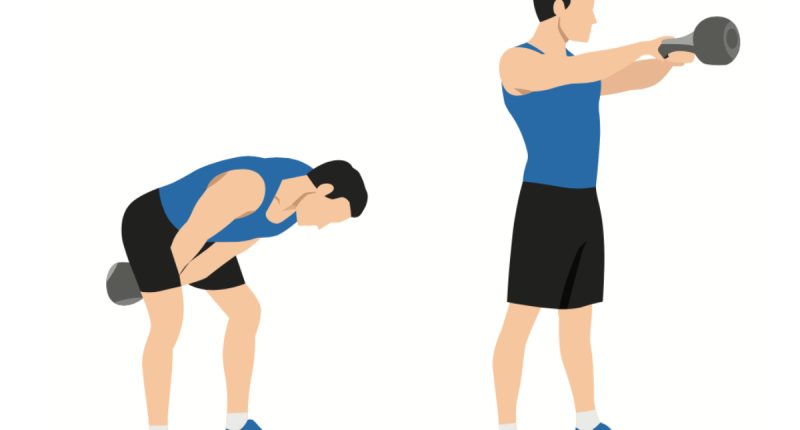

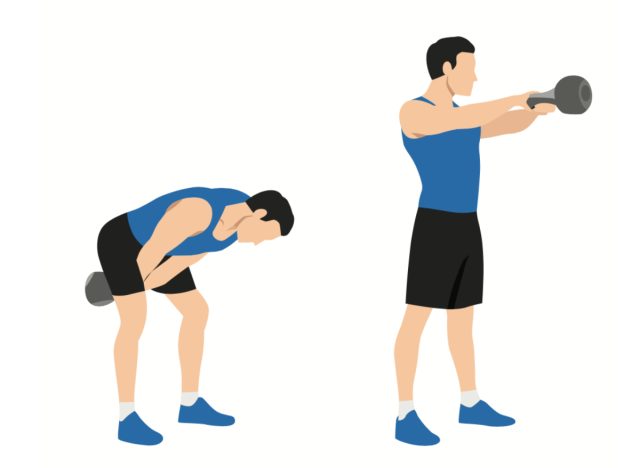

Kettlebell swings are an explosive exercise that engages multiple muscle groups, including the core, legs, and back. This full-body move torches calories and helps develop power and coordination. Mentus tells us, “Kettlebell swings are great for working the whole body, especially the core, and getting the heart rate up quickly.”

Stand with your feet shoulder-width apart, grasp the kettlebell with both hands, and swing it between your legs, then explosively thrust your hips forward to swing it up to chest height. Perform this movement for 30 seconds, followed by 30 seconds of rest for five minutes.

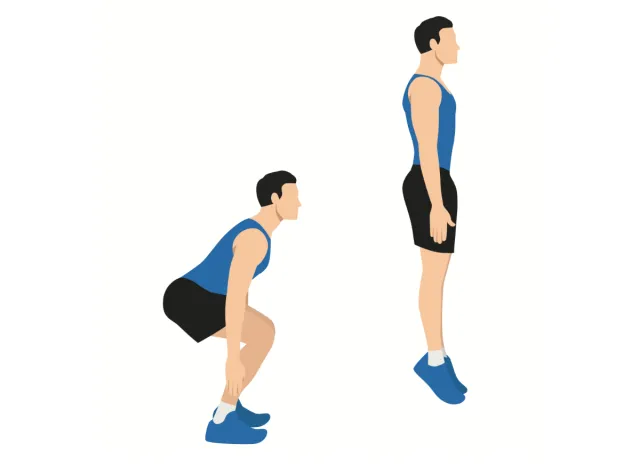

Squat jumps are a high-intensity exercise that gets your heart pumping while targeting your lower body. They’re excellent for building leg strength and torching calories.

“Lower into a squat position, keeping your chest up and back straight,” instructs Mentus. “Once you hit full squat depth, explode out of the bottom, jumping as high as you can vertically in the air. As you land, lower right back into a squat to continue into the next jump.” Shoot for 10 sets of 10 reps with 30 seconds of rest between sets.

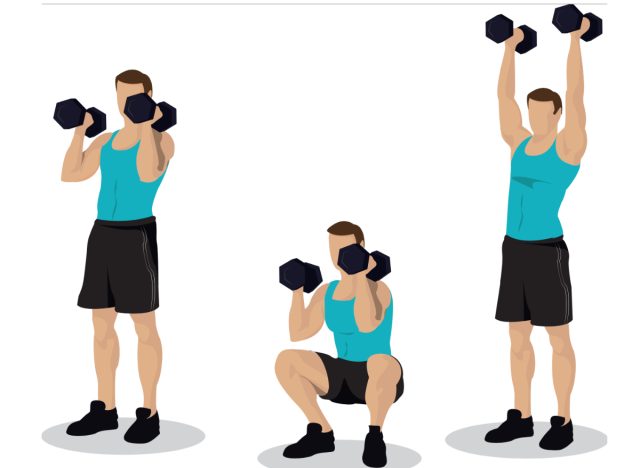

Thrusters are a powerful compound exercise that combines a squat and a shoulder press, effectively working your legs, core, and shoulders.

“With a dumbbell in each hand resting on the front of your shoulders, lower into a squat. In a single motion, stand up explosively out of the squat and press the dumbbells over your head using the drive from your legs,” says Mentus. Do four to five sets of 15 reps.

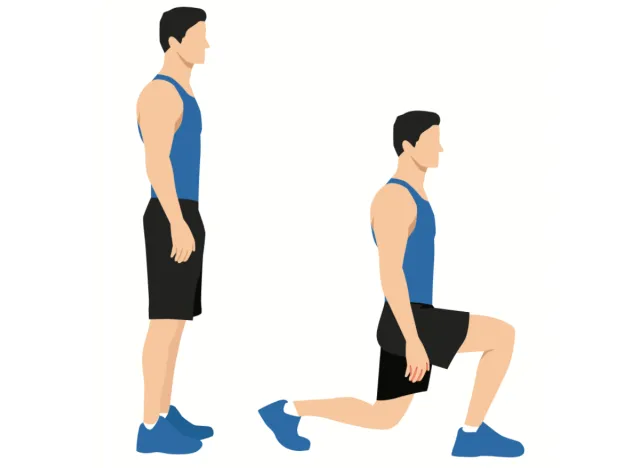

Walking lunges are a simple yet highly effective exercise for sculpting the legs and building stability.

“Step forward and lower into a lunge, bringing the back knee to the ground and making both knees into 90-degree angles,” says Mentus. “Push through your front foot, and bring your hips and back foot forward to return to standing. Repeat with the other leg.” Aim for six sets of 50 feet of walking lunges with 30 seconds of rest between sets.

Burpees are a challenging full-body exercise combining squats, pushups, and jumps. They’re fantastic for boosting metabolism and increasing cardiovascular fitness. “Burpees are the most effective bodyweight exercise for burning calories and fat,” states Mentus.

Start standing, drop into a squat, kick your feet back into a pushup position, return to the squat, and then explosively jump up. Try doing 30 seconds on with 30 seconds rest for five minutes.

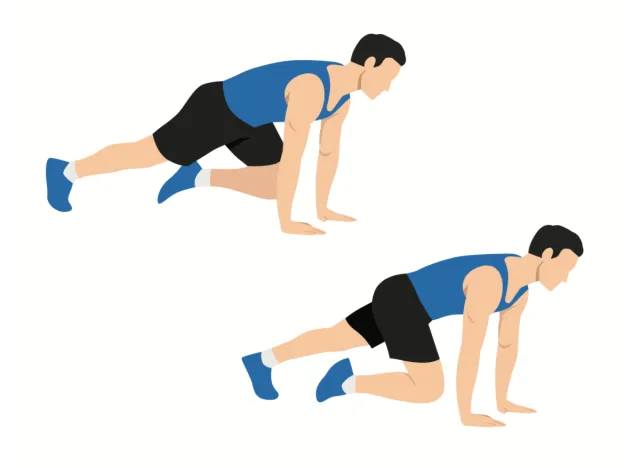

Mountain climbers are a killer core exercise that also elevates your heart rate.

“Get in a pushup position with your hands under your shoulders. Alternate bringing one knee into your chest as fast as possible while extending the other leg back,” explains Mentus. Try the Tabata method of 20 seconds on with 10 seconds of rest for eight rounds.

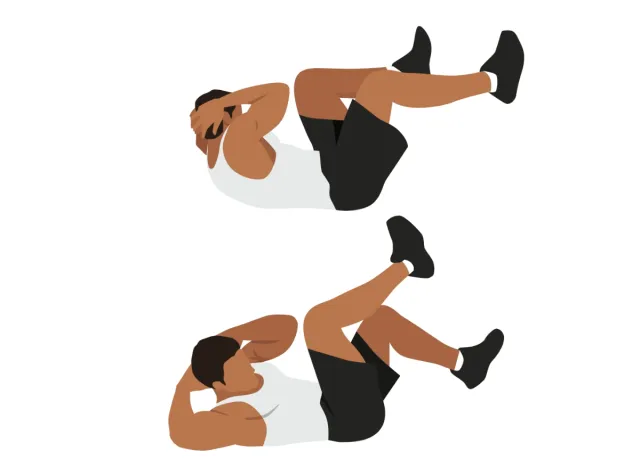

Bicycle crunches are a must for targeting your oblique muscles and sculpting a lean waistline.

Mentus instructs, “Lie on your back with hands behind your head, and pull one knee into your chest while keeping the other leg straight and off the ground. As you bring the knee in, crunch and twist, bringing the opposite elbow to the knee. Then, switch to the other side.” Perform three to five sets of 25 reps per side.

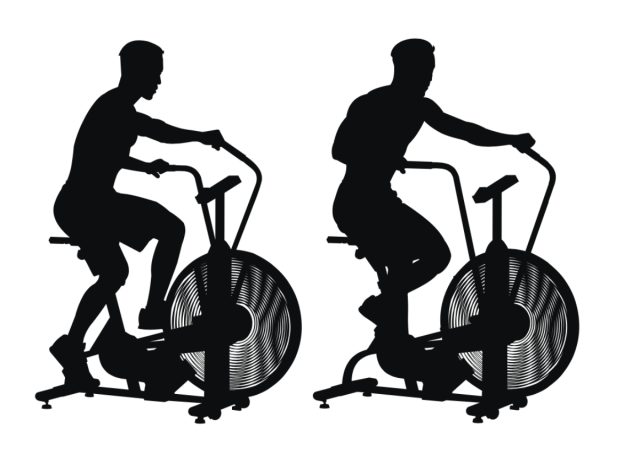

The air or stationary bike is excellent for cardiovascular conditioning and calorie burning. Pedal at a high intensity, incorporating speed and resistance intervals to engage your core and legs. “The air bike is different from a spin bike in that the arms are coordinated with the legs. This creates an even tougher workout and makes it even better for burning fat,” explains Mentus. Go hard for 10 calories, then bike slowly for one minute for 10 rounds.

Incline sprints are an intense cardio exercise that incinerates calories while strengthening your legs and glutes. “Sprinting is most effective for burning calories per minute,” says Mentus. “Also, adding the incline increases the challenge while decreasing the impact on your joints.”

Set the incline on a treadmill to 10, and use a speed that feels like a sprint for you. Sprint for 10 to 15 seconds, then walk for one to two minutes for 10 rounds total.

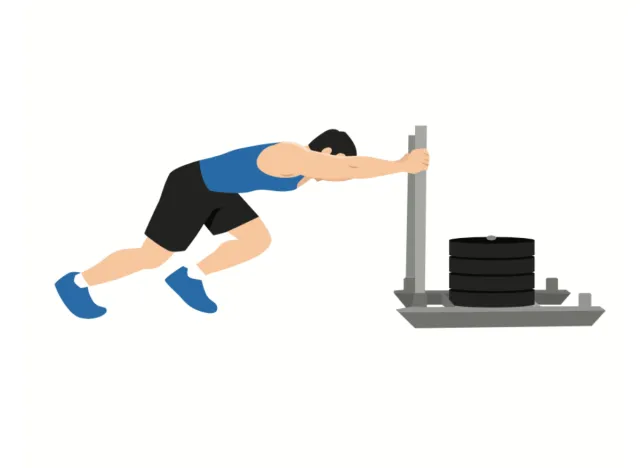

Sled pushes are a brutal yet highly effective exercise for building strength and power in the lower body and core.

“Load a sled with a moderate weight that takes effort to push. Grab the sled handles, and lean forward to flatten your back out so it is close to parallel with the ground. Push the sled by alternating, bringing one knee into your chest, then driving that leg to the ground to full extension. Once you get momentum, try to move the sled fast once you build momentum,” instructs Mentus. Shoot for five sets of 100-foot pushes with one minute rest between sets.

Don’t miss: The 10 Healthiest Sources of Protein You Can Eat