People Swear by the ‘3-2-8’ Workout to Lose Weight – If you’re ready to hop onto one of the latest fitness trends, we have just the right routine for you. People on TikTok swear by the “3-2-8 workout” to get fit, and once you give it a try, you are sure to be hooked, too. Not only that, but it’s an excellent way to boost your muscle strength and metabolism. We know you may be a tad skeptical, wondering if this fitness trend really lives up to the hype. Well, the workout method was curated by certified personal trainer and Pilates instructor, Natalie Rose, so you know it’s a must-try.

What is the 3-2-8 workout method?

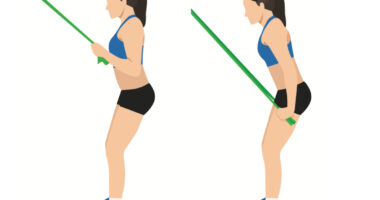

It’s always a great idea to switch things up in a workout routine. Not only can it kick up your progress, but it also helps you not get bored with what you’re doing. The 3-2-8 workout includes so much goodness. You will perform three barre/Pilates workouts each week, two days of strength training, and aim for 8,000 steps per day.

“If you’re ready to get in the best shape of your life,” Rose explains in her video, “start the 3-2-8 method. I started it when I came off birth control and I gained loads of weight. I didn’t really know what to do, and I didn’t get very good advice from the doctors. All they suggested I do is start some low-impact training and reduce my cortisol levels or go back on birth control, which I didn’t want to do. So I started following this method, and I lost so, so much, but I also found a method that works for my body and also allows me to stay consistent, because I am not burned out by the end of it.”

What a 3-2-8 week could look like.

Here’s the breakdown of what your week will look like when following the 3-2-8 method:

- Monday: Total-body strength workout

- Tuesday: Lower-body barre workout

- Wednesday: Power walk

- Thursday: Lower-body strength workout

- Friday: Barre or Pilates workout

- Saturday: 10-minute Pilates workout

People on TikTok can’t say enough good things about the workout plan. A TikToker who replied to one of Rose’s videos noted, “I’ve been doing the 3-2-8 with her for two weeks and I can already feel a big difference. Imagine what can happen in 12 weeks. She def not lying.” Another one wrote, “I have been on this plan for a month, and girl, I have seen the DIFFERENCE.”

Here are the benefits of the 3-2-8 workout method.

Eat This, Not That! reached out to Tyler Read, the founder of PTPioneer.com and a personal trainer who’s been involved in the health and fitness world for the past 15 years, to discuss the benefits of this fitness routine.

Read tells us, “There are a few reasons why this is an effective method to get fit. The barre/Pilates workouts are great for muscle toning and flexibility, core strength, and remain low impact which reduces wear and tear on your joints.” He adds, “The two strength workouts will help with muscle building, increasing bone density, and general functional fitness for day-to-day activity. Finally, walking 8,000 steps a day [supports] great cardiovascular health, burns more calories, and can help improve mental health by reducing stress and releasing endorphins.”

According to Read, combining these workouts together provides a variety of fitness adaptions that aren’t typically addressed by any one particular workout. The combination of strength-cardio and a group fitness class can also offer more benefits than if you were to focus on just one form of training.

Read points out, “If you are someone who gets bored or tired of a single modality very easily, the variety can keep you engaged and committed to your fitness program. In the long run, long-term consistency is responsible for delivering the maximal benefit from any fitness plan.”

kindly visit home for more